Insights

Market Outlook and Views of the Economy

Read about our thoughts on the market and how we are positioned to take advantage of future opportunities

Brookmont Capital provides high-level investment theses for each name in the portfolio

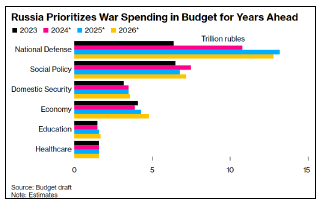

Market Rally Continues Amid Broadening Gains

A broadening market rally leaves room for thematic capital appreciation opportunities in various sectors such as defense.

Cooling Inflation and Signs of Economic Softening

Inflation showed signs of improvement, inching closer to the Fed's 2% target after a series of unexpectedly high Consumer Price Index (CPI) reports in Q1.

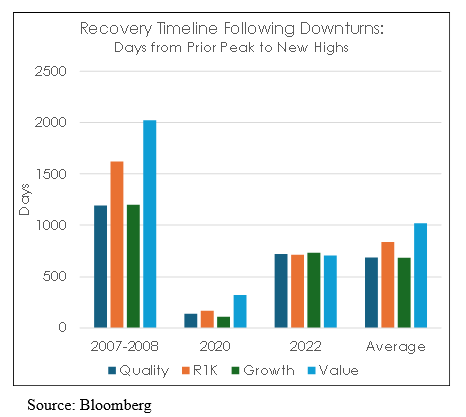

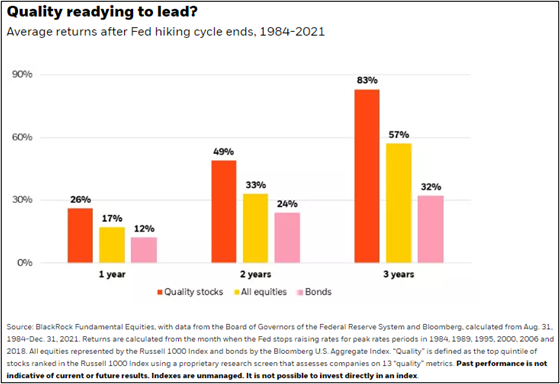

Quality Factor: What Most Allocators Overlook

Adding "quality" along with “value” and “growth” styles can cultivate greater downside protection, a less volatile portfolio, while still offering growth potential for long-term investors.

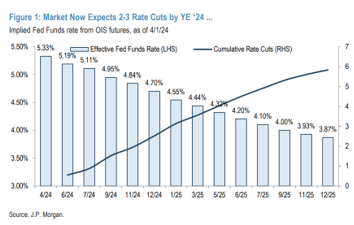

Fed rate cut expectations move from 7 to 2 over the First Quarter of 2024

In 2023, the U.S. experienced a phase of 'painless disinflation,' where inflation pressures decreased while the economy remained strong, boosting stock markets

2023 avoids recession, however colling inflation and global growth weigh on 2024

The IT and communication sectors contributed more than 70% of the total S&P 500 returns in 2023. Attractive secular growth drivers and quality companies should dominate in 2024

A Stubbornly Strong Economy Confounds Rate Expectations

Despite 18 months of Fed tightening actions, the economy still remains remarkably resilient. While inflation is slowing, it has remained firmly above the Fed's 2% target.

Whenever the Fed Hits the Brakes, Someone Goes Through the Windshield

The high-quality companies that we select to invest in are well capitalized with significant cash reserves and have easy access to credit, allowing them to invest organically in operations and take advantage during recessionary periods to capture additional market share.

Timing the Market is a Near Impossible Task

The stock market is highly unpredictable, and trying to time the market by actively trading in an attempt to capture short-term gains can be a challenging and potentially costly strategy.

Historic Rate Moves Drive Down Valuations

The Brookmont Investment Team discusses the expected recession, labor tightness affecting fed policy, the reopening of China, and looking at the 2023 equity markets.

A Hawkish Fed and Attractive Valuations

The Federal Reserve continues there hawkish actions and narratives due to the labor market while value stocks present long-term investors with attractive valuations.

Example of Strong Pricing Power (UPS)

Dividend Growth Stocks display strong pricing power by having the ability to pass along costs to their customers and improve their margins through efficiency improvements brought on by technology.

Inflation Labor, and Rates: Recession or Slowdown?

Core inflation has peaked and the ongoing labor shortage might provide the necessary cushion for a soft landing

Brookmont 2nd Quarter Commentary

Inflation, Resurgence of COVID Lockdowns in China, and the changing of supply chains.

Semiconductor Bullishness

The Brookmont research team discusses the secular and cyclical drivers for the bullish sentiment for the semiconductor industry

Brookmont 2022 Market Commentary

In this type of environment, it is important to still keep fundamentals in mind and focus on quality companies that produce growing cash flows, as these companies weather volatility in a more efficient manner than the overall market.

Delayed Demand, Inflation, and Political Uncertainty

3rd Quarter 2021 firm commentary

Interest Rates and Vaccination Rate Volatility Brings Buying Opportunities

Inflation fears and stalling unemployment have led to a volatile market, presenting buying opportunities for quality companies

The Importance of Pricing Power

Inelasticity of Demand and Pricing Power Reduces Inflationary Pressures

Speculative Assets Make News, Cyclicals Make Returns

2021 Market Commentary

The Great Lockdown resulted in a 31.4% decrease in annualized US real GDP in the second quarter. This, however, marked the bottom of the recessionary trough with real GDP rebounding 33.4% in the third quarter.

The Great Value Rotation

The work from home displacement caused by the Covid-19 pandemic has led to a peak in the Price to Earnings ratio of the Russell 1000 Growth...

2nd Quarter 2020 Commentary

During the 2nd Quarter of 2020, the market........

Rise of the Quarantined Day Trader

The COVID-19 lockdowns and zero commission brokerage accounts.....

Not All Dividends Are Created Equal

When searching for “quality” long-term investments, some of the most important and easily quantified measurements are those....

COVID-19 Update

The first four days of the week of March 23rd.....