Quality Growth Strategy

Brookmont’s disciplined approach finds value, strength and growth through unique insights and analysis.

Brookmont Quality Growth Strategy

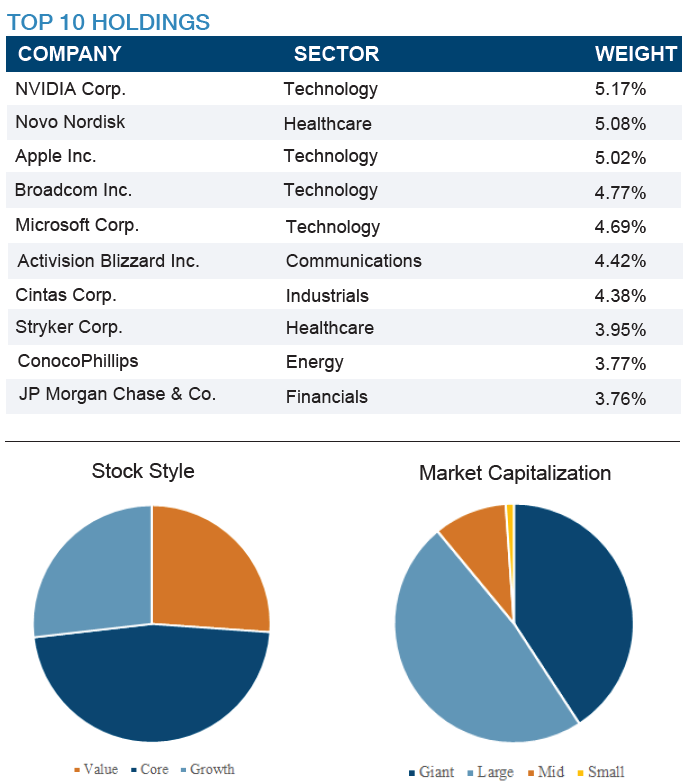

Our strategy is a total return portfolio of 30-45 common stocks that invests in equity securities that provide a moderate level of current income, an above average capacity for income growth, and the potential for long term capital gains with lower downside risks. The strategy typically invests in eight economic sectors as defined by the S&P 500 Index.

Investment Process

The firm utilizes its bottom up process facilitated by quantitative screens of fundamental characteristics to narrow the selection universe. Further fundamental analysis is performed incorporating Brookmont's macro investment themes to arrive at our proprietary dividend score.

Portfolio Structure

- Typically between 30-45 holdings

- Weightings range from 1.25% to 3.75% at time of addition

- Strategy typically invests in 8 sectors of the market

- Maximum sector weight of +/- 5% of benchmark sector weightings

- Strategy may invest in ADRs

- Low internal correlation between holdings

- Low turnover typically 5-20%

Portfolio Characteristics

#Holdings 32

*Average Market Cap. $340B

*Div. Yield FWD% 1.98%

*Payout Ratio 29%

*P/E (AVG) 26.12

**Beta 0.90

*As of September 30, 2023

** Since Inception January 1, 2015

Disclosures

This letter may contain "forward-looking statements" which are based on Brookmont’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available to Brookmont. Current and prospective clients are cautioned not to put undue reliance on such forward-looking statements, which are not a guarantee of future performance, and are subject to a number of uncertainties and other factors, many of which are outside Brookmont’s control, and which could cause actual results to differ materially from such statements. All expressions of opinions are subject to change without notice.

Brookmont Capital Management is a registered investment advisor that invests in domestic and global securities. Brookmont Capital is defined as an independent investment management firm that is not affiliated with any parent organizations

A complete description of Brookmont's performance calculation methodology, including a complete list of each security that contributed to the performance of this Brookmont portfolio is available upon request.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties, which in certain cases has not been updated through the date of the distribution of this letter. While such sources are believed to be reliable for the purposes used herein, Brookmont does not assume any responsibility for the accuracy or completeness of such information.

These individual securities do not represent all of the securities purchased, sold, or recommended for this Brookmont portfolio and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

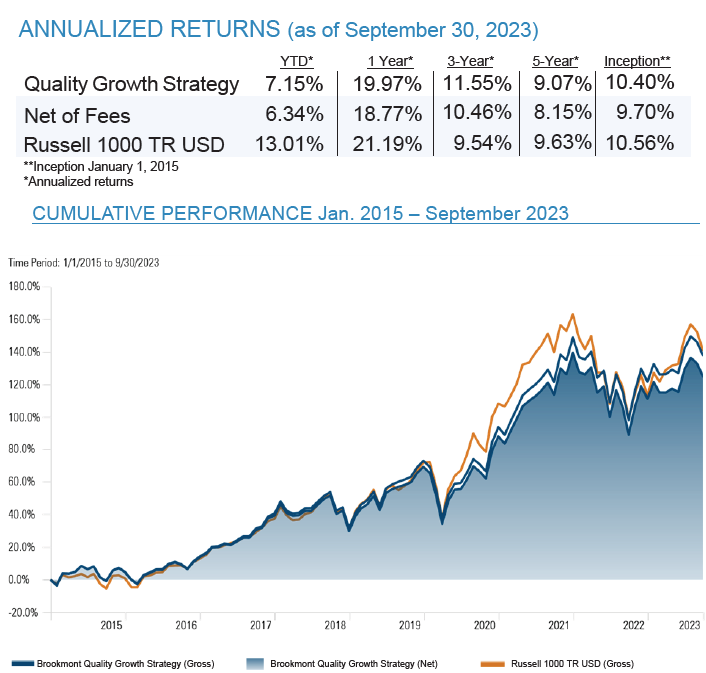

The Brookmont Quality Growth Strategy returns are based on an asset-weighted composite of discretionary accounts that include 100% of the recommended holdings. Individual accounts will have varying returns, including those invested in the Strategy. The reasons for this include, 1) the period of time in which the accounts are active, 2) the timing of contributions and withdrawals, 3) the account size, and 4) holding other securities that are not included in the Strategy. Dividends and capital gains are not reinvested. The Strategy does not utilize leverage or derivatives. Returns are based in U.S. dollars. The inception of the Strategy is January 1, 2015.

The Brookmont Quality Growth Strategy Composite contains fully discretionary accounts with similar value equity investment strategies and objectives. For comparison purposes, the Dividend Growth Strategy Composite is measured against the Russell 1000 Index. The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values. The Russell 1000 Index is constructed to provide a comprehensive and unbaised barometer for the large-cap value segment.

The firm maintains a complete list and description of composites, which is available upon request. Results are based on fully discretionary accounts under management, included those accounts no longer with the firm. Composite policy requires the temporary removal of any portfolio incurring a client initiated significant cash inflow or outflow of at least 15% of portfolio assets. The temporary removal of such account occurs at the beginning of the month in which the significant cash flow occurs and the account re-enters the composite at the beginning of the month which follows the cash flow by at least 30 days. Additional information regarding the treatment of significant cash flows is available upon request.

Brookmont's returns do include reinvestment of dividends and are shown gross-of-fees. All transaction costs are included. The Russell 1000 cumulative return includes reinvestment of dividends and capital gains. During a rising market, not reinvesting dividend could have a negative effect on cumulative returns. There is no representation that this index is an appropriate benchmark for such comparison. You cannot invest directly in an index, which also does not take into account trading commissions and costs. The Volatility of this index may be materially different from the performance of the Strategy. Gross returns will be reduced by investment advisory fees and other expenses that may be incurred in the management of the account. Net-of-fees performance was calculated using actual management fees. Additional information regarding the policies for calculating and reporting returns is available upon request.

Your account returns might vary from the composite's returns if you own securities that are not included in the Strategy or if your portfolio dollar-cost averaged into the Strategy during the reporting period.

Brookmont Capital Management claims compliance with the Global Investment Performance Standards (GIPS®). To receive a complete list and description of Brookmont's composites and a presentation that adheres to GIPS standards, please contact Suzie Begando at 214-953-0190 or write Brookmont Capital Management, 5950 Berkshire Lane, Suite 1420, Dallas, TX 75225.

The Brookmont Quality Growth Strategy is available through several institutional platforms and registered investment advisors that are not affiliated with Brookmont Capital Management. Required minimum investments and advisory fees differ from one firm to another.

Brookmont Capital does not provide comprehensive portfolio management services for investors who have not signed and Investment Management Agreement with our firm.

Past performance is not indicative of future results.