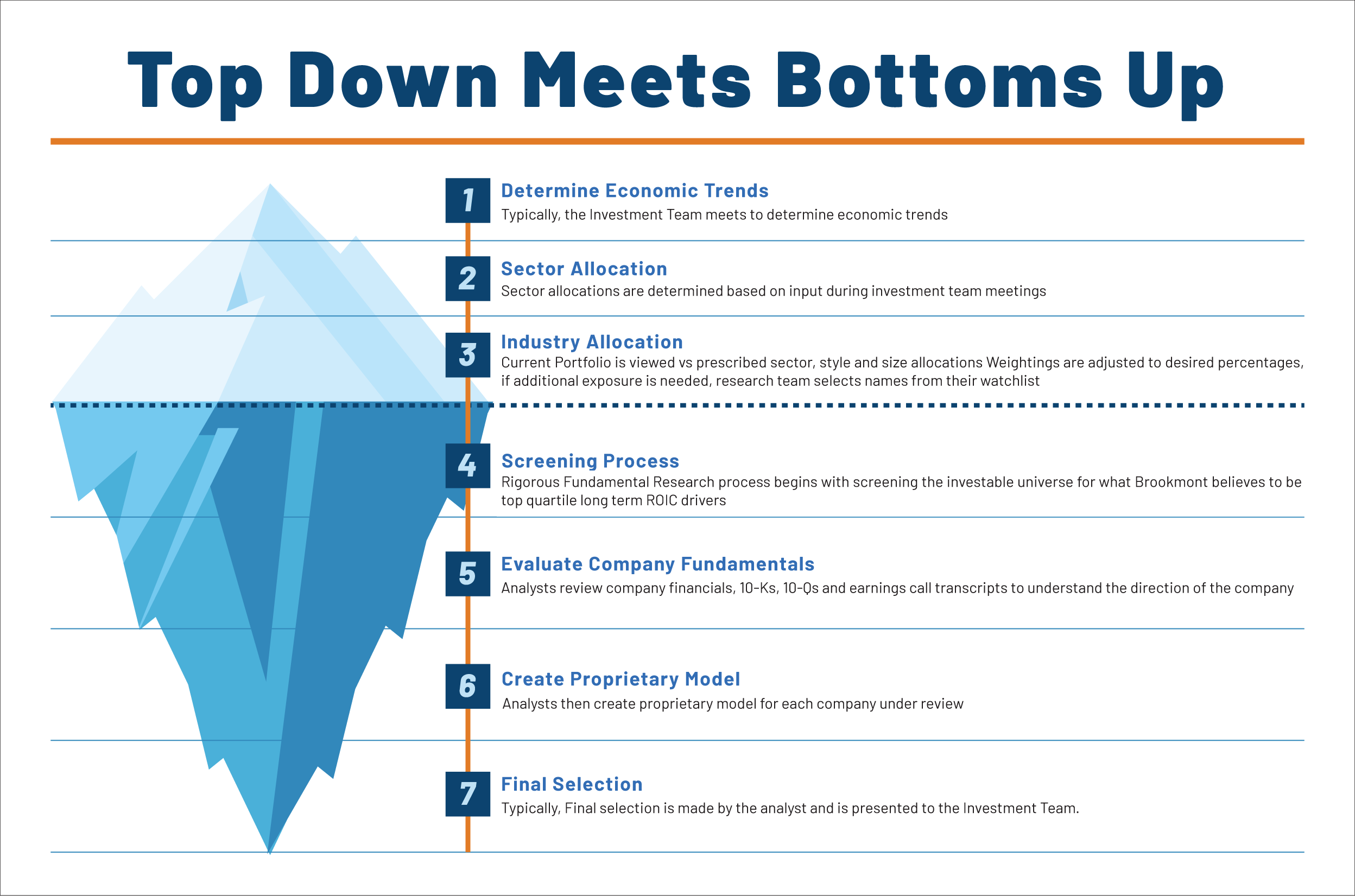

Process

At Brookmont, we believe that high conviction portfolios of between 30-50 names, combined with low turnover, is the key to generating alpha.

We rely primarily on superior security selection while employing macro investment themes throughout the portfolio. However, we also diversify across sectors with an over or under weighting not to exceed +/- 5%.

Once our themes and outlook have been determined, the firm utilizes quantitative screens of fundamental characteristics to search for companies that align with any necessary allocation changes prescribed by the top down outlook. Absent changes to our top down outlook, which are infrequent, all strategies are managed in a bottom up fashion by our top down outlook.

Bottom Up

Brookmont’s bottom up process involves both qualitative and quantitative aspects. First and foremost, the team gains understanding as to how the sector or industry in question operates, what trends are causing changes and how those trends will affect the business in the future.

Qualitatively, the process is structured to uncover how the company is viewed by its customers, competitors, employees, and the public at large, to gauge the company’s position in its industry. Additionally, the Brookmont team researches management motivations by virtue of their compensation, stock ownership, and preference for dividend payment, among other items.

Quantitatively, there are numerous screening variables that the investment team considers both on an absolute and relative basis including but not limited to: the magnitude and frequency of dividend increases, the capacity for dividend increases measured by various liquidity and coverage ratios, revenue growth, available high ROIC investments, credit ratings and margins. Our fundamental analysis concludes with creation of models to conservatively estimate available return.