Philosophy

At Brookmont, we focus on quality companies with strong sustainable free cash flow and solid fundamentals. Our bottom up fundamental analysis and security selection process is supported by analyzing overarching economic trends and themes.

Quality Growth

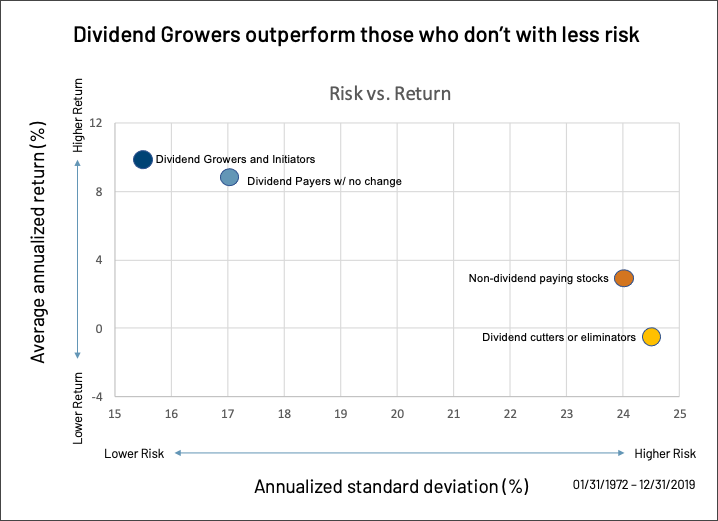

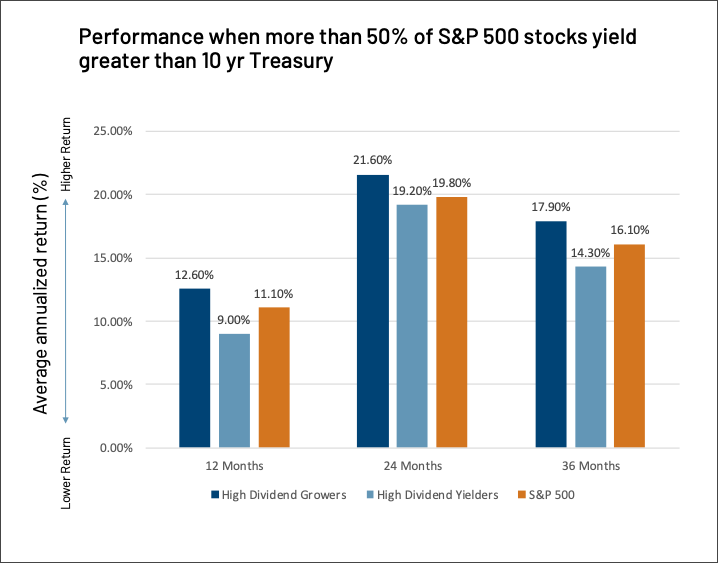

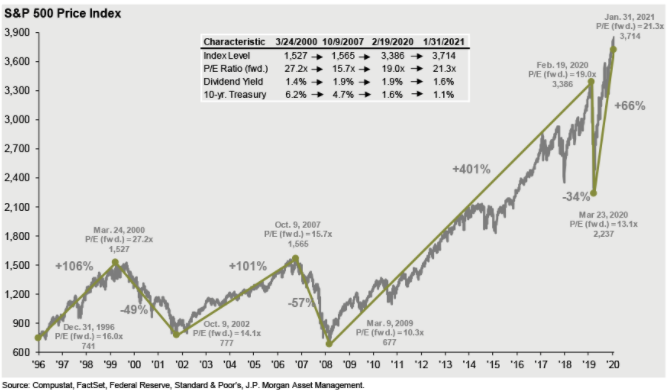

We contend that investing in companies that not only provide current income but have the capacity to initiate and grow a dividend maximizes the intrinsic benefits of dividend investing (lower volatility, less downside capture). To be effective in identifying such companies, we are highly selective, employing a research process that addresses all components of total return.

Dividend and Cash Flow Focus

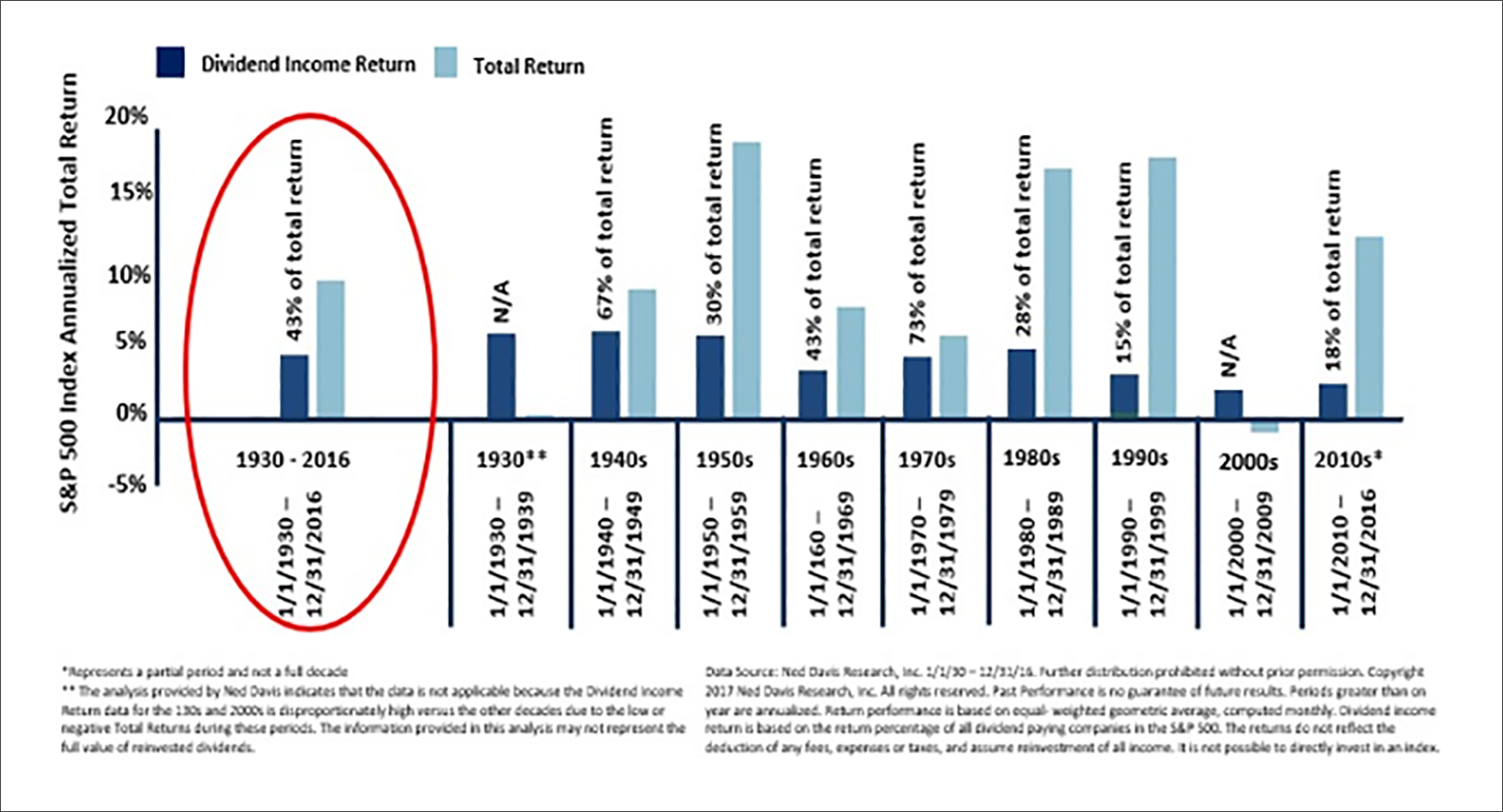

Numerous empirical studies of long-term real returns show dividends account for the largest, most stable and lowest volatility component of total return.1 Furthermore, we believe that against a backdrop of changing demographics the appeal of dividends will increase.

Dividend Paying Equities

We invest in quality companies because, in conjunction with providing current income, dividend paying securities exhibit lower downside capture and lower volatility than their non-dividend paying counterparts.2 In our experience, we have found that dividend paying companies are typically financially sound with strong balance sheets, which make for ideal characteristics for a portfolio focused on preserving capital in down markets.

Highly Selective

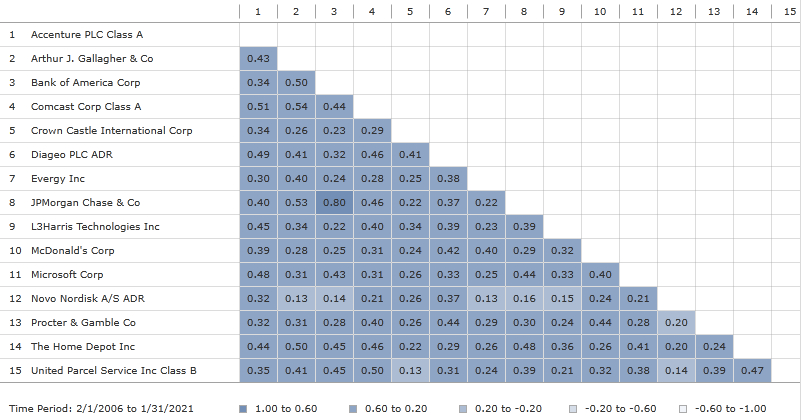

To maximize the benefits of stock selection, we actively manage concentrated portfolios of between 30-50 stocks. The growth and sustainability of a company depends on their competitive advantage which is nurtured by a competent management team that exhibits prudent capital allocation.

Portfolio Data As of 09/30/2024

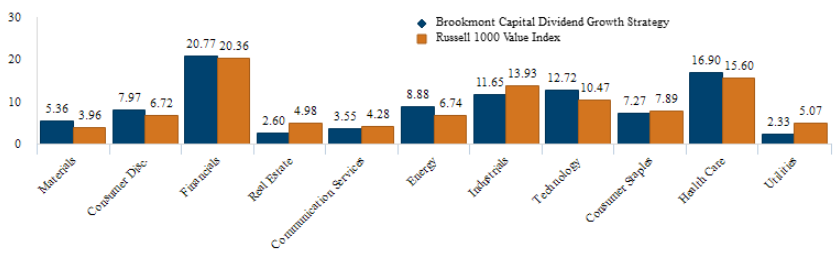

Diversification

Focusing on internal correlation and end market exposure rather than broad sector classifications ensures that portfolios have adequate breadth to endure business cycle fluctuations.

Long Term Focus

We believe that quality dividend paying securities exhibit visible fundamental growth characteristics versus highly speculative securities which are reliant on unreliable valuation assumptions. A longer investment horizon provides a lower portfolio turnover maximizing after tax returns. Finally, this allows for thematic investments to experience outsized gains caused by the realization of market shaping trends.

1 Ned Davis Research

2 Ned Davis Research